Get the Best Life Insurance for Teachers with Affordable Term Life Insurance Plans

What Is A Life Insurance Policy?

A life insurance policy offers financial protection for your family when you pass away. In that inevitable moment, there are two deaths: your individual departure, mourned deeply by your family, and the loss of the financial protection you provided. The individual you choose, called the beneficiary, is entrusted with the life insurance proceeds, utilizes the funds as they see fit, ensuring security during this challenging time, both emotionally and financially.

When Should You Get Life Insurance?

You have a need for life insurance when you experience major life events, for example:

- If you were recently married

- You just bought a new home

- You're expecting a new child

- You have others depending on your income

What Are The 2 Main Types Of Life Insurance?

Term Life Insurance

Term Life Insurance is a type of life insurance recommended by experts like Dave Ramsey and Suze Orman because it offers the highest coverage amount for the lowest cost. You pay a little bit of money every month for a specific amount of time (typically for terms of 10, 20, or 30 years), and if you pass away in that timeframe, your family gets a paycheck in the amount of money that you qualified for when you applied for the policy. And if you outlive the term, you could be investing in high quality mutual funds to become financial independent.

Permanent Life Insurance

Permanent life insurance, sometimes known as whole life insurance, universal life insurance, or index universal life insurance, is a long-term coverage plan that lasts throughout your lifetime. According to nerdwallet.com, permanent life insurance provides a death benefit and it contains a savings component in the policy, called cash value, that has the potential to grow over time. However, this is not what we recommend due to the high costs of these policies and the low performance of the savings component.

Life Insurance Through Your School District Doesn't Count

Work-provided life insurance offers you a small amount of coverage, but it often falls short in meeting the comprehensive needs of your family. According to a study by the Life Insurance and Market Research Association (LIMRA), work-provided life insurance typically provides coverage equivalent to only one to three times your annual salary, which is insufficient for your family (considering your debt, income replacement, funeral expenses, and the rising cost of living). Additionally, coverage ends when you terminate employment or become disabled over 90 days and are taken off active payroll, leaving you without protection during crucial periods. Furthermore, the reliance on workplace coverage leaves you vulnerable, as you do not have control over the policy or the ability to customize it to your specific needs. To ensure robust coverage, experts like Dave Ramsey or Suze Orman often recommend supplementing your work-provided life insurance with a personal policy tailored to your circumstances.

Meet Molly - A One Of A Kind School Teacher

Molly was a one-of-a-kind teacher who taught for many decades in Ohio. She had a tradition of having her students write a letter to themselves, and when they were about to graduate as seniors in high school, she had those students come back to her classroom and read those letters they had written to themselves for the first time. However, on the way back to getting a cake from the store for this reunion with her graduating senior class, she got into a car crash and died. Her impact left a big hole in the community. But when death occurs, there are two deaths: a physical death and a financial death. Molly passed away with only life insurance coverage through her school district, and it ended up not paying out. Thus, her husband and kids were left to struggle financially right after losing Molly. Teachers, please do not leave yourself in this vulnerable life insurance situation to face the death of a loved one and financial struggle!

Educators We Serve - Client Testimonials

Grant & Alyssa C.

Saratogo Springs, UT

I've loved how much peace we have from knowing we're investing in smart ways. Plus, even if, heaven forbid, one of us passes away our kids still have a bright future.

Jeffrey M.

Mesa, AZ

Knowing my family is financially protected means everything to me. The process was very simple and quick for getting the life insurance my family needed and it was within our budget.

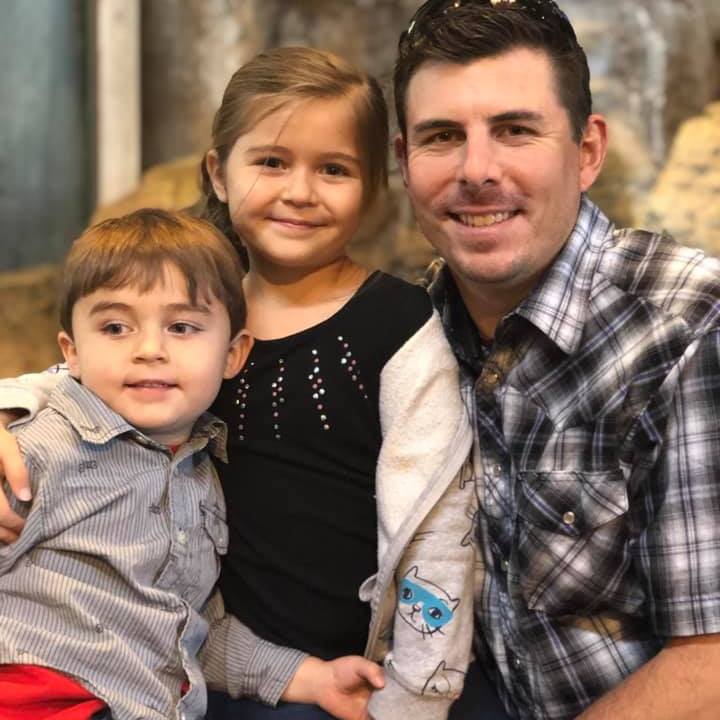

Ryan E.

San Tan Valley, AZ

Thanks to Thriving Teachers Today they made the process for getting life insurance super easy. Knowing we'd leave millions for my kids future makes me feel fulfilled as a parent.

Jen & Carlos P.

Queen Creek, AZ

We've been clients of Thriving Teachers Today for a decade. They have been super patient in educating us on the best financial tools and the personal connection we have with our financial advisor has made it super worth it to be a life insurance client.

Charles & Rachel K.

Orem, UT

Thriving Teachers Today has really taught us the value of being prepared financially. They personally took the time to help us understand the value of life insurance and helped us get a policy so we can leave behind generational wealth just like they teach.

Nate & Casia F.

Mesa, AZ

These guys are super cool and really good at what they do. They've made a million dollar difference for my family and can for yours too. I wouldn't do business with any other company because I know these guys actually care about what they do.

Brian & Linea G.

Clayton, NC

Working with Thriving Teachers Today has been so illuminating. It has taken financial information we never thought was for us as middle class Americans and made it accessible, useful and profitable for our family.

Kate & Adam D.

Kuna, IR

I wouldn't have been interested if it wasn't for the friendship and consistent persistence of the Thriving Teachers Today team. The financial peace is a bonus because I have learned more about how finances here than anywhere else.

Travis & Wendy M.

Sacramento, CA

It's nice that the Thriving Teachers Today team has become our friends and not just someone we talk finances with. Plus they explain things in a way that's super easy to understand and not high pressure sales talk.

Thriving Teachers Today

3707 E Southern Ave. Mesa, AZ 85206

Schedule A Free Financial Consultation For A Life Insurance Quote